Here is a good companion story to the one I posted yesterday about how nearly half of all Americans have no retirement savings. The Consumerist has the details:

If you and your loved one are looking down the road toward living out your golden years together, be prepared to have a pile of cash stashed away to cover your medical bills.Let's see, the average couple is going to need nearly a quarter of a million dollars to cover their health care costs in retirement, and yet half of all American adults have no retirement savings of any kind, let alone for health care.

Fidelity Investments has released its annual projection on health care costs for retirees and calculated that a couple retiring now will need $240,000 to get through their remaining decades. That's an increase from last year's projection of $230,000.

The bank had cut the number for the 2011 report, citing portions of the Affordable Care Act that should reduce seniors' out-of-pocket expenses for prescription drugs. But Fidelity says medical costs are still going up, thus the rebound from last year's unprecedented dip.

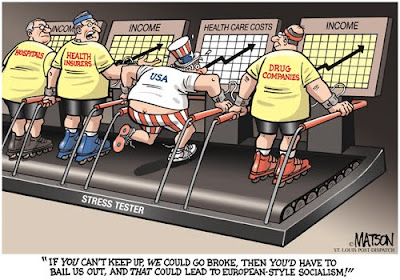

"As long as health care cost trends exceed personal income growth and economic growth, health care will still be a growing burden for the country as a whole and for individuals," says Sunit Patel, a senior vice president for benefits consulting at Fidelity.

This will not end well.

Bonus: From my You Tube channel, "Doctor, my eyes...Tell me what is wrong...Was I unwise to leave them open for so long?"

The way things are going for my wife and I, we'll be lucky to have 100k put aside. We are in our early 50s and have friends our age with nothing or very little saved.

ReplyDeleteEven in good times it is difficult to save that kind of money on an average income. I think you are right. I don't think the future will be very bright for most of us.

I have a single shotgun shell with '401k' written on it.

ReplyDeleteProbably use it to retire in the lobby of Blue Cross or other insurance company HQ.