This is a good companion piece to the post I made yesterday about CNN being in denial that there may be a crisis in the student loan industry. It's bad enough that many young adults are carry huge education-related debt burdens, but now it also appears that student loans are going to follow some people right into the grave. Here is Yahoo News with the story:

New research from the New York Fed shows Americans 60 years and older owe a collective $36.5 billion in outstanding student loans. More than 10 percent of these indebted seniors are delinquent on their loans, which means they may field calls from persistent debt collectors and be forced to offer up parts of their Social Security checks to satisfy their decades-old debts, the Washington Post reports.Notice how that last bit almost perfectly mirrors the propaganda put forth in the CNN story? It almost like the media collaborates in the lies it tells the public. Who would have ever thought?

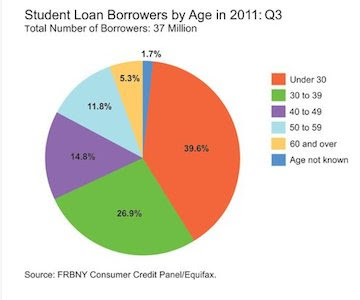

Most people with student loans are under 40, but because this type of loan cannot be discharged in bankruptcy, the debt can follow a person around for life. The average amount due from all student loan borrowers is $23,300, according to the New York Fed's data, while the median amount is $12,800. On average, college graduates make significantly more over their lifetimes than high school graduates and face a lower unemployment rate. But college costs have skyrocketed over the past 30 years, and the potential payoff of a college education varies widely, depending on which subject a person majors in and the value and reputation of the college.

Bonus: "Old man, look at my life...I'm a lot like you were (or maybe are now)"

To borrow from Kunstler, education has become "just another racket in an all-rackets society."

ReplyDeletePrecisely.

ReplyDeleteMy daughter graduated in 2011 and recently sent me a survey of the employment statistics of her class. Let me preface this with the fact that her college was a tier 1 liberal arts college with an outstanding reputation.

Currenly, only 31% of her graduating class has full time employment. 16% are in graduate or professional school. The rest are in situations outside of those two options.

This school runs an annual tab for student attendance of around $50,000 each.

How long can such colleges continue to attract students who will pay that amount of money even with such poor employment statistics after they get out?

John, that's awful. I really feel for you daughter's class. Not being able to find a job upon graduation was my nightmare when I was in college.

DeleteOn top of which, even those dismal figures are likely misleading. It is standard practice for colleges and universities to hire their own graduates in order to inflate the employment percentage.

DeleteAlso sorry to hear that John. One tendency I have noticed among current and recent graduates at undergrad institutions who are facing a brutal job market is the temptation to "double down" on a graduate degree that may only land them in more debt.

DeleteE.g., for anyone considering law school, PLEASE READ THIS BLOG by a law school professor who gives the straight dope about job prospects for aspiring and recent JDs:

http://insidethelawschoolscam.blogspot.com/

I don't believe the prospects for MBAs and various other grad degrees are a lot better, unfortunately. Getting a graduate degree is a highly risky strategy for riding out the economic storm. My first piece of advice to young grads is STAY OUT OF DEBT.

Bill, I think All Along The Watchtower might be a more appropriate song for the occasion.

ReplyDelete"There's got to be some kinda way outta here,"