Showing posts with label stock market. Show all posts

Showing posts with label stock market. Show all posts

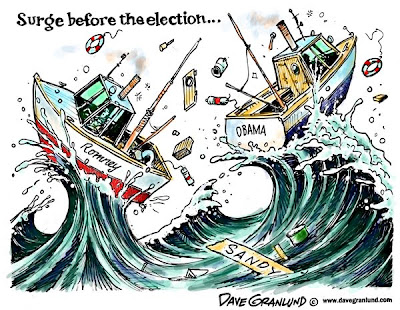

Monday, October 29, 2012

The New York Stock Exchange is Reportedly Under Three Feet of Water

The good news for me is that I haven't lost power yet. The silver lining news is that according to The Weather Channel's live blog, the New York Stock Exchange has been inundated with floodwaters.

From other reports, New York City sounds like it is in chaos. Sandy actually turned out to be WORSE than expected. Tomorrow is going to be interesting.

Update: Disregard. TWC is now saying that the first report about the NYSE was erroneous. As usual, the little people suffer while Wall Street gets off the hook.

Bonus: "New York City's killing me"

Thursday, May 3, 2012

Green Mountain Coffee Executives "Baffled" By Declining Sales

The big news in the stock market this week was the plunging sales of Green Mountain Coffee, which caused the company's stock to sink dramatically. Here is CNN with the story:

Green Mountain Coffee Roasters shares plummeted Thursday after the company reported quarterly revenue that missed estimates and lowered its guidance for 2012.As usual in these situations, the suits don't have a clue:

Green Mountain (GMCR) shares sank nearly 40% in early morning trading Thursday, dipping to about $30 after closing Wednesday at $49.52.

The company's quarterly earnings came in line with expectations at 64 cents a share, though its $885 million in sales missed estimates of $972 million.

Green Mountain also reduced its fiscal 2012 sales guidance from between $4.3 and $4.5 billion to between $3.8 and $4 billion. The full-year earnings-per-share projection was cut from between $2.55 and $2.65 to between $2.40 and $2.50.

In a conference call with analysts, Green Mountain executives said they didn't have a full explanation for why sales were weaker than expected. They suggested that low brewer machine sales and weak demand for holiday drinks during the warm winter -- like cider and hot cocoa -- were partially to blame.Please allow me as a former Green Mountain customer to offer up a possible explanation. I used to love Green Mountain coffee after having discovered it more than a decade ago when it was still a small regional concern. I even went out of my way to order it online back when it was not available in the stores in my area.

"We're very positive about this business going forward, but there's a lot of moving parts," Green Mountain CEO Larry Blanford said.

Green Mountain currently dominates the single-serving coffee market with its popular Keurig, or K-Cup, machines.

It was one of the fastest-growing companies of the past decade and one of the best-performing stocks, handing investors 110% gains on an annualized basis until last fall.

Nowadays, I can even buy it in my local supermarket. But I don't. In fact, I ordered up my last ever batch of the stuff about a year ago. And you know why? Because the coffee now tastes like ass. I don't know what the difference is between how they make the stuff now and how they made it a decade ago. All I know is what my tastes buds tell me.

Somewhere along the way, Green Mountain became far more concerned with expansion than it did about putting out a good product. But that is par for the course in corporate America these days.

Bonus: Instead of some Green Mountain, how about some Green Day...because I came around on Green Mountain

Monday, April 9, 2012

Sony To Cut Global Workforce By 10,000

There was no immediate word on how many jobs the Sony Corporation will be cutting stateside as a result of their mass layoff announcement today. Here is MarketWatch with the story:

Sony Corp is planning to cut its worldwide workforce by about 10,000, or by 6%, with the layoffs coming by the end of the year, according to a report in the Nikkei newspaper on Monday. Seven senior managers, including Chairman Howard Stringer, are expected to give up their bonuses for fiscal 2011, the Nikkei said. Sony reported a net loss for the recent fiscal year ended in March, dragged in part by a poor performance at its LCD television unit, with the earnings result marking its fourth straight loss-making year.The story also contained more proof that the stock market has gone completely insane:

Sony's shares, which fell 3% earlier in the day, rebounded as much as 1.5% following the report. The stock ended the day 0.6% higher.Yep...because there is nothing like having your potential customer base reduced by 10,000 to boost those sales of useless LCD televisions.

Sunday, January 29, 2012

The Truth is in the Housing Sales Numbers, Not the Stock Market

It should be evident by now to any observer who has more than two brain cells to rub together that the stock market has for nearly three years been pumped up by the Federal Reserve in order to create the illusion of an economic recovery that just does not exist in reality. But while the Fed's easy money policies have given the big banks and Wall Street the liquidity they need to drive up the price of stocks (and other asset classes) from their March 2009 lows, what they haven't done is put money back in the pockets of working and middle class people. Consumers may still be whipping out the plastic to buy cheap crap from China in order to make themselves feel more prosperous than they really are, but when it comes to the biggest ticket item of all, housing, as the chart above from Calculated Risk shows, the country remains mired in a deep depression.

In fact, here are a couple of very telling quotes from two different posts Calculated Risk made on the subject last week:

2011 was the worst year for new home sales since the Census Bureau started tracking sales in 1963. The three worst years were 2011, 2010, and 2009 - and 2008 is also on the worst ten list.But wait...there's more:

In December 2011, 21 thousand new homes were sold (NSA). This was the weakest December since this data has been tracked, and was below the previous record low for December of 23 thousand set in 1966 and tied in 2010. The high for December was 87 thousand in 2005.That's right, we just had the worst year ever for new home sales, and December, despite all of the hype regarding holiday retail sales, was the worst month of the worst year ever. And this happened, we must remember, at a time when rates for a 30-year, fixed rate mortgage have fallen BELOW 4%.

Buying a home has always been, and remains, at the very heart of the American Dream. If people could still afford to buy real estate, especially at these mortgage rates, they would. The fact that they are not speaks huge volumes about the real state of the economy, despite the rise of the manipulated stock market.

The media has been hyping up the fact that the weekly unemployment claims numbers have fallen and that the monthly jobs data has shown a steady, if still sluggish increase in employment over the last year. The question they never ask in following up is: what kind of jobs are these that are being created? Are they higher paying jobs that provide the employee with a ticket to the middle class which will allow them to live the dream and buy their own home? Or are they menial, near minimum wage paying retail and service sector jobs that keep one on the edge of poverty and buying a house well beyond their means? The housing sales statistics seem to strongly indicate the latter.

Unless and until we start to see a real and sustained upturn in the number of homes being purchased, I think we can safely say that the rhetoric about economic recovery is nothing more than lies and propaganda spewed forth by a media machine of behalf of it's ever increasingly desperate masters.

Bonus: "I'm homesick for the home I've never had"

Labels:

economic collapse,

housing crash,

stock market,

unemployment

Sunday, December 4, 2011

Yes, Virginia, Our State Fair Has Declared Bankruptcy

image: The Virginia State Fair in better times, circa 2010

You know that times are getting tough when state fairs start to declare bankruptcy:

Many residents of Richmond, Henrico and her surrounding counties have found memories of the State Fair. We remember going when it was located off Laburnum Ave, and most of us can still conjure up the aromas of cotton candy and hot dogs, mixed with the earthy smells emitting from the livestock exhibition buildings.Who knew that state fairs were heavily invested in the stock market? Actually, I have to admit I really don't know all that much about state fairs. I haven't attended a fair of any kind since I left my small Illinois hometown for good nearly a quarter-of-a-century ago, although I used to have a lot of fun at the annual local county fair when I was a kid.

Today it was announced in the Richmond Times-Dispatch that VASF will be filing for Chapter 11 Bankruptcy. According to President and CEO Curry A. Roberts, this is a one-time financial event, and is a responsible step to take.

Most of the problem is in the repayment of the principal and interest in the organizations' financial portfolio, of which half of the loans have already been repaid since 2007. The drop in the stock market in 2009 was a major factor in creating the financial disparity leading up to the filing today.

In these modern times with most family farms having been bought out by giant agribusinesses, state fairs seem like quaint relics of a bygone era. Looks like soon they will just be gone.

Thursday, October 27, 2011

Greece is "Saved" - All is Well

So...the powers that be did it again. Greece is "saved." The DOW just shot back over 12,000. All is well, citizen.

Seriously, that's what they want you to believe. I wrote about this very issue back on July 14th, in my post: "Why We’re Screwed (Part 4): The Propaganda Ministry Touts the Dow Jones Industrial Average." Here's what I said then:

There is perhaps no more observable example of the Hologram in action than the relentless touting of the stock market indices, the Dow Jones Industrial Average (DJIA) in particular. Every cable “news” channel features a stock ticker that provides updates in real time all day long. The evening news shows, despite only having about 21 minutes per half hour broadcast to sum up the day’s events, always makes sure the stock results get highlighted—even on that bane of right wing conservatives everywhere, National Public Radio. It’s been this way for so long that no one ever questions why that should be.Since I wrote that post, those in charge have developed another reason to drive the markets back up, namely the rise of the Occupy Wall Street protests. A stock market crash now would go a long way towards legitimizing the protesters in the eyes of your average American couch potato.

Why promote the DJIA so relentlessly when it’s the upper 10% of households that own a majority of stocks while the lower half of wage earners own virtually no stocks at all? The networks insist on persistently pumping a figure of little meaning to a vast majority of the population. What’s more, most of those who do have large stock portfolios presumably get their financial information from sources far more sophisticated than the nightly news. And if they don’t, they shouldn’t be investing in stocks in the first place.

The only answer I can come up with is that the DJIA is being used a propaganda device to help sell the narrative that all is fine with the economy. Since the depths of the market crash in March 2009, the DJIA has regained nearly all of its pre-crash losses.

Yes, stocks are way up. Whoo-hoo, happy days are here again. Pop the cork on the champagne, honey, tonight we are going to celebrate.

Don’t pay any attention to the fact that the rally was bought and paid for by the Federal Reserve’s Zero Interest Rate Policy and Quantitative Easing programs; the federal government’s $700 billion bailout of the big banks and Wall Street; and an additional trillion dollars of annual deficit spending being added over and above the already high deficit levels of President Bush’s last full year in office. Also ignore the fact that even with the recent run-up, stocks are not much above where they were in 2000, meaning you could have kept your money under your mattress for the last 11 years and been just as well off—not to mention that you probably would have slept better during the market’s many wild gyrations.

The very purpose of all the reckless post-crash economic policies was primarily to pump up the stock markets. In the minds of our economic overlords, it was imperative that at least the facade of prosperity be propped back up in order to quickly dissipate the doom and gloom mentality that accompanied the financial crash. Consumer spending represents approximately 70% of the American economy, so they had to get the plebes to open their wallets and pull out the plastic again. Coaxing folks back into the shopping malls required getting them to stop worrying about the future and to resume partying like there’s no tomorrow.

So if you still have your money in stocks, enjoy this ride, because it likely won't be too long before the roller coaster makes its next dip.

Monday, October 3, 2011

Australian Investor: America Has Become a Bad Bet

Much as I hate the overused corporate-speak phrase "think outside the box," there is a lot of value in being able to view yourself as others might see you so that you may correct your deficiencies. Sadly, the phrase has been beaten to death by fools and charlatans who are so invested in our failing system that they would "shoot the messenger" (to use another shopworn bit of corporate-speak) if anyone really did tell them the truth about themselves.

All of that is an introduction to an interesting op-ed piece that appeared on the website Digital Journal over the weekend from an Australian financial writer named Paul Wallis entitled, "Hey, Corporate American Idiots--You're Costing Us Money," which does a pretty fair job of spelling out what so few Americans are able to see about their own country. Wallis starts off by enumerating America's various mounting problems:

Fiscal- The Federal credit card has maxed out, and the income for the states has been chaotic for many years. The US revenue system is an antique based on 19th century legislation which has nothing in common with real revenue needs. The US is persisting with a policy of zero interest rates which has already failed dismally in Japan, and the results seem to be much the same.Or ever, I might add. Wallis then goes on to advise foreign investors that they should consider pulling their money out of America:

Business- The dichotomy between Main Street and Wall Street is now looking irreparable. Wall Street isn’t achieving anything of note which is valuable to the US economy as a whole. This is business by numbers gambling. The big dips in the market are leaving a trail of trashed, and largely unnoticed, investors. It's musical chairs with capital, and the losers are stacking up.

Social- An encyclopaedia couldn’t do justice to the social issues in the US, even as a simple list. Crime, poverty, violence and the collapse of the entire structure of the postwar boom will have to do as a sketch.

There’s no thinking and no fixes being offered, just some general tinkering with a machine that doesn’t work anymore. There’s no vision- No great ideals, no empathy, and above all no practical approaches with bipartisan support. Obama has proposed a minimal fix to a massive problem, and even that will have to stagger through the geriatric fruit fly intellects of Washington to get anywhere, probably not before the 2012 election.

For foreigners, the problems are magnified by their level of investment in the United States. Pulling out of an investment at a loss is never a welcome idea, but sticking around and just taking more losses is even less palatable.Ouch, that's gonna leave a mark. Wallis concludes his article with a flourish:

Foreign investment in the US used to be a very good idea. It’s now looking like a particularly efficient form of suicide, particularly in equities and capital investment. The business culture in the US is also an acquired taste. The vast array of useless, overpaid and underachieving networking middlemen is hardly a recommendation. The “thought leaders” are senescent jokes, looking more like they’re doing a crossword than any actual thinking about major issues.

Listen, you tenth-rate entomological scumbags- You’re costing us billions per day. You're living in a sewer and pretending to be celebrities. You want charity, find a mirror in a public toilet somewhere and play a kazoo. Don’t expect anyone to believe this garbage. Get the act together, now.Okay, here is where I have to draw the line. I'm so sorry--NOT!--that it has taken the likes of Mr. Wallis so long to wake up to the fact that America's financial system is bankrupt not only in terms of its balance sheet, but morally and ethically as well. That should have been readily apparent to anyone with two brain cells to rub together after the financial crash of 2008. If, after all that mess, you kept your money invested in America's hopelessly corrupted system and lost your ass, well then I have absolutely NO sympathy for you whatsoever. Go make yourself a Vegemite sandwich and get over it, already.

The real underlying problem, of course, is that the American economy was built on the idea that cheap oil would be available forever and ever. And now that the era of cheap oil is over, our economy is headed for a disastrous fall. So you see, Mr. Wallis, it doesn't matter whether American business "leaders" were to suddenly "get their act together" as you are so emphatically imploring them to do. Even if they somehow managed to do so in the manner you suggest, they would be just as screwed. And so are you, unless you wake up to the unpalatable reality that is standing right behind you, tapping you on the shoulder.

Labels:

economic collapse,

national debt,

politics,

stock market

Tuesday, August 9, 2011

Capitulation

I don’t write about the stock market very often on this blog, mainly because I haven’t owned any stocks since back in 2005 when I got spooked about the obvious incompetence of the “leaders” running our economy. Never once have I been tempted to get back in since then, not even during the hallucinatory Federal Reserve-fueled rally off of the March 2009 lows. Sure, there was lots of money to be made provided you were prepared to bail out at the first sign of trouble, but the sharp rise was based upon the biggest fraud yet perpetrated in the financial markets, and I had no desire to be a part of any of that.

The TARP law bailing out the big banks, the Zero Interest Rate Policy of the Fed, the Recovery Act stimulus law, two rounds of Quantitative Easing, Cash for Clunkers, New Homebuyer Tax Credits; all of these programs and more plus an extra three trillion dollars in federal deficit spending over and above 2008 levels bought us exactly two-and-a-half years of kicking the can down the road. Now we’re back at square one, and the politicos—from Obama to Geithner to Bernanke to Reid to Boehner—have shot their collective wad trying to salvage the unsalvageable.

This is the only way it could possibly have turned out, of course. In my July 14th post, “Why We’re Screwed (Part 4): The Propaganda Ministry Touts the Dow Jones Industrial Average,” I wrote the following:

If you spend a lot of time watching our corporate owned and thoroughly corrupted mainstream media, you might have the rather ridiculous idea that the American economy is in the midst of a recovery from the recession that accompanied the 2008 financial crash. Sure, there might have been some bumps along the way, but expansion has resumed as evidenced by two years of positive GDP growth and the fact that jobs are being created again. It’s just a matter of time now before all of the unemployed folks are back to work and home values resume soaring to the stratosphere.In that very same post, I asserted that the stock market numbers, which were being deliberately goosed by the U.S. Treasury and the Federal Reserve, were also being used as a propaganda device to convince the masses that the “recovery” was real in order to get them spending again. Thus I concluded:

Sadly, far too many people still believe all that nonsense. They have failed to notice that the only thing propping up the so-called “recovery” is an insane amount of U.S. Government deficit spending ($1.5 trillion annually out of $14 trillion dollars in total economic output), without which the GDP numbers would be an astonishing 10.7% lower than they have been the past three years. There’s no other way to spin those figures—three straight years of double-digit economic contraction are Great Depression numbers. That’s why for tens of millions of people it doesn’t FEEL like the economy has recovered, whatever the news might say. If you got laid off in 2008 or early 2009 and weren’t lucky enough to get a stimulus program-funded government contract, you were likely left to become a “99’er” whose unemployment benefits are now running out.

At some point, those doing the manipulating will run out of ammunition and there will be another crash. They will then no doubt argue for more bailouts, more stimulus and more quantitative easing to get this whole cycle going all over again. We’re now so far in the hole, that trying to keep the game going a little longer is all they have left. The problem is, by that time the dying economy may have finally reached the point where all attempts at emergency resuscitation prove ultimately futile.Which is what makes the outcome of the recent debt-ceiling debacle all the more remarkable in its collective lunacy. Blind faith in the system and the idea that real, organic economic growth not tied to federal deficit spending was about to resume was a key pillar propping up the whole creaking façade of business as usual in the economy. The politicos with their insane antics—running the timeline for a debt deal right up to the edge of default and then refusing to take any realistic measures to reduce the deficit— shook that pillar until the whole rotten edifice came crashing down on their heads.

So where do we go from here? The future is unknowable, of course, but if I had my guess I would bet that in the real economy we’re about to see another huge wave of commercial bankruptcies and accompanying layoffs. I suspect there are many companies that have been treading water waiting for the expected real recovery to take hold that will now succumb to the inevitable and go under. This will, of course, cause tax revenue to plunge yet again and ratchet up the pressure on already financially strapped governments at every level, causing government employees to also lose their jobs in ever-greater numbers.

As total employment decreases, and the ratio of those with jobs to those being supported by government programs also continues to decrease, we will eventually reach a point where the government can no longer tax and borrow enough money to keep the system functioning. This will mark the true moment of collapse. As to how long that will take, it’s anyone’s guess.

Thursday, July 14, 2011

Why We’re Screwed (Part 4): The Propaganda Ministry Touts the Dow Jones Industrial Average

If you spend a lot of time watching our corporate owned and thoroughly corrupted mainstream media, you might have the rather ridiculous idea that the American economy is in the midst of a recovery from the recession that accompanied the 2008 financial crash. Sure, there might have been some bumps along the way, but expansion has resumed as evidenced by two years of positive GDP growth and the fact that jobs are being created again. It’s just a matter of time now before all of the unemployed folks are back to work and home values resume soaring to the stratosphere.

Sadly, far too many people still believe all that nonsense. They have failed to notice that the only thing propping up the so-called “recovery” is an insane amount of U.S. Government deficit spending ($1.5 trillion annually out of $14 trillion dollars in total economic output), without which the GDP numbers would be an astonishing 10.7% lower than they have been the past three years. There’s no other way to spin those figures—three straight years of double digit economic contraction are Great Depression numbers. That’s why for tens of millions of people it doesn’t FEEL like the economy has recovered, whatever the news might say. If you got laid off in 2008 or early 2009 and weren’t lucky enough to get a stimulus program-funded government contract, you were likely left to become a “99’er” whose unemployment benefits are now running out.

So why aren’t more people up in arms? Why are there not massive demonstrations on the Washington Mall and elsewhere? Why have we not seen Greek-style rioting here in America? So far, such activity has been limited to some campus unrest out in California; a few weeks of union-backed demonstrations in Wisconsin that accomplished exactly nothing except for some relatively meaningless local recall elections; and the faux-outrage of the billionaire funded and utterly compromised tea party movement. As far as genuine anger out in the streets goes, Americans have been as docile and accepting as a newborn lamb.

The answer should be pretty obvious. What the late author Joe Bageant called the American Hologram has been working overtime on behalf of its corporate masters, spewing forth happy-talk financial propaganda when not serving up celebrity-spectacle distractions and vapid reality shows to keep its viewers fat, and if not happy, at least not in a rightly justifiable rage.

Conversely, if you really want to understand what’s happening with the American economy, you actually have to READ, something which many Americans find as abhorrent as having to take the stairs instead of using the escalator. Some print sources have done a reasonable job of covering different aspects of the ongoing economic malaise, and there are many places on the Internet where the truth is presented without the cheerleading spin. But as far as the vast majority is concerned, those reports might as well be buried under that flag Neil Armstrong planted in the Sea of Tranquility back in 1969.

There is perhaps no more observable example of the Hologram in action than the relentless touting of the stock market indices, the Dow Jones Industrial Average (DJIA) in particular. Every cable “news” channel features a stock ticker that provides updates in real time all day long. The evening news shows, despite only having about 21 minutes per half hour broadcast to sum up the day’s events, always makes sure the stock results get highlighted—even on that bane of right wing conservatives everywhere, National Public Radio. It’s been this way for so long that no one ever questions why that should be.

Why promote the DJIA so relentlessly when it’s the upper 10% of households that own a majority of stocks while the lower half of wage earners own virtually no stocks at all? The networks insist on persistently pumping a figure of little meaning to a vast majority of the population. What’s more, most of those who do have large stock portfolios presumably get their financial information from sources far more sophisticated than the nightly news. And if they don’t, they shouldn’t be investing in stocks in the first place.

The only answer I can come up with is that the DJIA is being used a propaganda device to help sell the narrative that all is fine with the economy. Since the depths of the market crash in March 2009, the DJIA has regained nearly all of its pre-crash losses.

Yes, stocks are way up. Whoo-hoo, happy days are here again. Pop the cork on the champagne, honey, tonight we are going to celebrate.

Don’t pay any attention to the fact that the rally was bought and paid for by the Federal Reserve’s Zero Interest Rate Policy and Quantitative Easing programs; the federal government’s $700 billion bailout of the big banks and Wall Street; and an additional trillion dollars of annual deficit spending being added over and above the already high deficit levels of President Bush’s last full year in office. Also ignore the fact that even with the recent run-up, stocks are not much above where they were in 2000, meaning you could have kept your money under your mattress for the last 11 years and been just as well off—not to mention that you probably would have slept better during the market’s many wild gyrations.

The very purpose of all the reckless post-crash economic policies was primarily to pump up the stock markets. In the minds of our economic overlords, it was imperative that at least the facade of prosperity be propped back up in order to quickly dissipate the doom and gloom mentality that accompanied the financial crash. Consumer spending represents approximately 70% of the American economy, so they had to get the plebes to open their wallets and pull out the plastic again. Coaxing folks back into the shopping malls required getting them to stop worrying about the future and to resume partying like there’s no tomorrow.

There was nothing else that could be touted which would achieve the same effect. The GDP numbers swinging back over to the positive in the summer of 2009 wasn’t going to do it, as far too many people don’t really comprehend what that abstract concept really means. Besides, GDP is only reported once a quarter—and thus is not very useful for the daily drum beat. The unemployment numbers continued to relentlessly suck despite the upward bias in the government’s calculations, so there was no help there. And they certainly couldn’t hype a real and non-manipulated indicator like the number of Americans on food stamps, because that one was literally exploding in the wrong direction.

No, they had to focus on the rebound in stocks, which was a win-win since it fit into what their agenda was anyway—making good the losses experienced by the same group of predatory capitalists who caused the market crash in the first place with their reckless financial bets. This is why I have stopped paying attention to the stock market and the DJIA altogether. The last time it had any value as a true economic indicator was in late 2008 and early 2009, before all the massive manipulations began to take effect. In addition to what I’ve written above, how can you trust any institution where on average an asset is held for mere seconds before being transferred from one supercomputer's data bank to another?

At some point, those doing the manipulating will run out of ammunition and there will be another crash. They will then no doubt argue for more bailouts, more stimulus and more quantitative easing to get this whole cycle going all over again. We’re now so far in the hole, that trying to keep the game going a little longer is all they have left. The problem is, by that time the dying economy may have finally reached the point where all attempts at emergency resuscitation prove ultimately futile.

Subscribe to:

Posts (Atom)